Introduction:

In their search for the distinct worlds of trading cryptocurrencies vs trading stocks, investors and traders encounter two areas of interest. Both offer attractive prospects for wealth accumulation, but differ substantially in their underlying characteristics, volatility and mechanics.

Cryptocurrencies, with their decentralized and blockchain based foundation are bringing a radical paradigm shift to the financial landscape. Their innate insights and security mechanisms redefine traditional concepts of money, creating a decentralized system that transcends geographic boundaries However, this same decentralization often contributes to the incredible volatility associated with the crypto market of the market, presenting challenges and opportunities for savvy investors.

On the other hand, stock markets represent an established and traditional way of investing. Companies issue shares, offering dividends and profit sharing to investors. The stock market, governed by established regulatory frameworks, operates in a more predictable pattern compared to the relatively nascent crypto market and while this position can be reassuring, perhaps potential gains will not match the pace of growth seen in the cryptocurrency space.

These financial circumstances require careful consideration of risk tolerance, investment objectives and timing of guidance. Cryptocurrencies can offer high-risk, high-reward scenarios, which are attractive for ease of volatility and demanding high returns. In contrast, funds may appeal to investors seeking a more aggressive long-term growth trajectory, which is consistent with a conservative approach to wealth accumulation.

Understanding the unique characteristics of each segment allows investors to make informed, informed decisions.

Stocks (Owning a Slice of Business):

Let’s go into the familiar territory of stocks. Imagine buying part of a real-world business, like a part of your favorite local store or a large company like Apple or Amazon. Every part of you is like a little master in that business. The efficiency, profitability, and health of the business all directly affect your share price.

Think of it this way like Stocks are like getting a small prospectus. So, if the company does great things and makes a lot of profit, your ownership card (or shares) are worth a lot. It is all about collective confidence in the ability of the company and its shareholders to raise money.

Cryptocurrencies (The Digital Adventure):

Now, let’s step into the fascinating realm of cryptocurrencies. These are like digital treasures, which exist entirely in the online world and are powered by something called blockchain technology. Unlike stocks, they have no physical form, and no superpower or government behind them. Instead, their value depends on how much of it is available, cool new technology, and what people think about it.

Think of this as a digital rollercoaster: The price of cryptocurrencies can go up and down really fast. The value is based on popularity, the introduction of exciting new tech, and what other people feel about them. But here’s the thing – you can’t easily use it like regular money anymore for everyday things. They’re a bit like rock stars in the digital world, exciting and full of potential, but not everyone uses them for their everyday shopping yet.

Key Differences at a Glance:

Here are some fundamental distinctions of Trading Cryptocurrencies Vs Trading Stocks,

1. Market Accessibility and Hours:

Stocks (Opening Hours and Set Times):

Let’s talk stocks first. These are similar to in-store items, but the store is only open during certain hours, such as 9:30 am to 4:00 pm in the US. It’s a bit like opening and closing times for your favorite store. Therefore, you can only buy or sell stocks when the market is open, making it more organized and predictable.

Cryptocurrencies (Always Open for Business):

Now, imagine that the crypto market never closes its doors. Cryptocurrencies work 24/7, which means you can trade at any time, day or night. It’s like having a store that’s open round the clock. This constant availability sounds cool, but it also means that the value of cryptocurrencies can change really fast, like a roller coaster that never stops. So, while convenient, it can also be a bit unexpected.

2. Ownership and Keeping Things Safe:

Stocks (The Ownership Paper Trail):

Well, let’s talk about owning stocks. It’s like having a small special owner’s card. To do this, you need to open something called a brokerage account, identify yourself, and follow a set of rules set by the big people in charge. Owning stock doesn’t just stay alive – you can receive some other benefits like dividends (basically a portion of the company’s profits) and even have a say in some decisions through voting rights. Everything is clear and follows a rule to be correct.

Cryptocurrencies (Your Digital Treasure Chest):

Now, consider owning cryptocurrencies like a digital treasure chest. It’s a bit like a secret adventure because you put them in something called a digital wallet, and you have private keys to unlock it. This gives you a lot of privacy, but here’s the thing: it also means you have to be extra careful. Losing your digital wallet is like losing the key to your treasure chest forever. And once it’s gone, it’s gone forever – there’s nothing to get back. So, while it’s cool to have this digital treasure, it comes with a lot of responsibility.

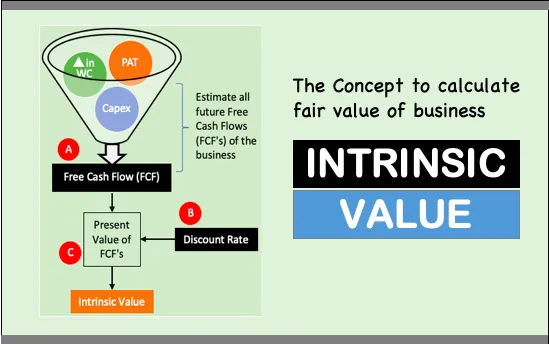

3. Intrinsic Value or Guesswork?

Stocks (Real-World Assets):

Let’s talk about stocks and what it’s like to own a few pieces of the real thing. The value of a stock is linked to actual companies and products. How well a company is doing, what’s going on in their business, and how the economy is doing – all of these affect the price of a stock. Investors look at these factors, such as studying a company’s prospectus, to make smart choices.

Cryptocurrencies (A Bit like Crystal Balls):

Now, think of cryptocurrencies as magic money with nothing behind it. Unlike stocks, they have no correlation with real things. Instead, their values are based on what people think will happen, like an expensive guessing game. If a celebrity says something about them, or they have news about the law, or if people just start talking about them a lot on social media – all of these things can cause the price of cryptocurrencies to suddenly rise or fall. It’s a bit like trying to predict the future, sometimes it feels more like magic than anything else!

4. Rules and Watchdogs (Stocks vs Crypto):

Stocks (Following the Big People’s Rules:

Let’s talk about stocks and how to play by some big rules. You see, important bodies like the SEC in the US. Targeting banks there. They make sure everyone plays fair and companies share their financial statements. There seem to be some officials who make sure that everything is clear and that no one is trying to deceive anyone.

Cryptocurrencies (Still Figuring Things Out):

Now, imagine the world of crypto is a little wild west. Different places have different rules for cryptocurrencies. Some really like them, while others are a bit unsure. Because the rules are not the same everywhere, it can seem a little confusing. Sometimes there is uncertainty, and from time to time there is pressure to make sure everything is perfect. It seems the rules are still being written, and everyone is figuring out how to make things work.

5. Taking Risks Stocks and Crypto:

Stocks (Safer Paths with a Twist):

Let’s talk about taking risks in stocks. They are generally considered a safe option because they are associated with big, prestigious businesses. People who invest in stocks generally look for slow and steady growth, like a mouse in a race. They may also get a little reward called a dividend, which is like getting a patience pill. But remember, not all stocks are the same – some zoom forward, while others move a little slower.

Cryptocurrencies (The Rollercoaster Ride):

Now, imagine that cryptocurrencies are a roller coaster of fun. Investing in them is like jumping on a lot of highs and lows. Some people enjoy the excitement and opportunity to make a big profit. However, it is not for the faint of heart as waterfalls can be difficult. Crypto investments can shoot to the stars or crash down really fast. It’s like a wild adventure that attracts people who love adventure and adventure. So, when it comes to risk and reward, stocks can be stable, while crypto is a wild rollercoaster ride.

6. Flowing Markets (Stocks and Crypto):

Stocks (Busy Markets with No Surprises):

Let’s say markets are like rivers – some quiet and deep. So, when we have stocks, we are great rivers. The big stock exchanges are like markets and Amazons, super busy with lots of buying and selling every day. This makes them deeper and less susceptible to big waves. When you want to work, it’s like floating well on a well-flowing river, generally going where you expect.

Cryptocurrencies (Some Rivers Are Narrow):

Now, consider crypto-streams as something different. Some, like Amazon, are super busy and deep. Others are more like narrow rivers. Trade volumes (or flows, in our river analogy) can vary significantly between different cryptocurrencies. If the coin doesn’t trade much, it’s like a small stream – it doesn’t take much to make a big splash. So, while some crypto streams are volatile and predictable, others can be somewhat unpredictable, and trading may not be as smooth as larger stock streams.

7. Feelings in Trading (Stocks and Crypto):

Stocks (A Dash of Emotions):

Think of stocks as friends you invest in. Sometimes you get emotionally attached to someone. You know, like cheering on your favorite sports team. Investors often get emotional about the companies they invest in. These emotions can sway decisions – when things are going well, you may feel happy, but when things are going wrong, it can feel a bit like a rainy day.

Cryptocurrencies (The Rollercoaster of Emotions):

Now, think of cryptocurrencies like a thrilling movie. Emotional stuff is cranked up to the max. There’s this thing called FOMO (Fear of Missing Out) – it’s like when everyone’s talking about a movie, and you don’t want to miss it. In the crypto world, this can make people jump in without thinking too much. On the flip side, when things get bumpy, it’s a bit like panic – imagine the tension in a suspenseful scene. Rational thinking sometimes takes a backseat on this wild emotional ride. So, in the world of feelings and trading, stocks are like a friendly chat, while crypto are an emotional rollercoaster.

Wrapping it Up (Stocks, Crypto, and Your Financial Journey):

Now that we’ve ventured into the world of stocks and cryptocurrencies, let’s summarize the Trading Cryptocurrencies Vs Trading Stocks. Each of these areas has its own unique features – some are like stable neighborhoods with familiar faces (stock), others are like a bustling city with a shiny new charm (crypto) it is worth noting that both have cool possibilities to make money and a bit of a roller coaster ride comes along.

Whether you’re someone who’s been around the bankruptcy a few times or just stepping into this exciting world, seeing the difference of Trading Cryptocurrencies Vs Trading Stocks is like a good map. It helps you understand where you are and where you want to go. So, remember, stocks and crypto are like two different roads in the same forest – each with its own puzzles and adventures.

These differences between Trading Cryptocurrencies Vs Trading Stocks are not limited to professionals, it is for anyone who wants to join the journey. So, whether you’re an experienced traveler in the financial jungle or an adventurous wanderer, knowing these differences is like adjusting a flashlight to guide you through the dynamic financial landscape and in the transformation. Interesting research!

16 Responses

Nice blog here Also your site loads up fast What host are you using Can I get your affiliate link to your host I wish my web site loaded up as quickly as yours lol.

Somebody essentially help to make significantly articles Id state This is the first time I frequented your web page and up to now I surprised with the research you made to make this actual post incredible Fantastic job.

I sincerely enjoyed what you have produced here. The design is refined, your authored material trendy, yet you appear to have obtained a degree of apprehension regarding what you aim to offer next. Certainly, I shall return more frequently, just as I have been doing almost constantly, provided you uphold this incline.

I genuinely relished what you’ve produced here. The outline is elegant, your written content trendy, yet you appear to have obtained some anxiety regarding what you wish to deliver thereafter. Assuredly, I will return more frequently, akin to I have almost constantly, provided you maintain this incline.

I sincerely appreciated the effort you’ve invested here. The sketch is tasteful, your authored material chic, however, you seem to have developed some uneasiness about what you aim to offer henceforth. Certainly, I shall revisit more regularly, just as I have been doing nearly all the time, should you uphold this climb.

I genuinely savored the work you’ve put forth here. The outline is refined, your authored material trendy, however, you seem to have obtained some trepidation about what you wish to deliver next. Assuredly, I will revisit more regularly, akin to I have nearly all the time, provided you maintain this upswing.

I genuinely admired what you’ve accomplished here. The outline is elegant, your written content fashionable, however, you seem to have acquired some unease about what you wish to present going forward. Undoubtedly, I’ll revisit more often, similar to I have nearly all the time, in case you sustain this ascent.

I sincerely enjoyed what you’ve accomplished here. The sketch is fashionable, your written content chic, yet you appear to have developed some apprehension regarding what you aim to offer thereafter. Certainly, I shall return more frequently, just as I have been doing almost constantly, should you uphold this upswing.

I genuinely enjoyed the work you’ve put in here. The outline is refined, your written content stylish, yet you appear to have obtained some apprehension regarding what you wish to deliver thereafter. Assuredly, I will return more frequently, akin to I have almost constantly, provided you maintain this climb.

I sincerely enjoyed what you have produced here. The design is refined, your authored material trendy, yet you appear to have obtained a degree of apprehension regarding what you aim to offer next. Certainly, I shall return more frequently, just as I have been doing almost constantly, provided you uphold this incline.

I truly relished the effort you’ve put in here. The sketch is stylish, your authored material chic, however, you seem to have developed some anxiety about what you intend to deliver subsequently. Assuredly, I will revisit more regularly, akin to I have nearly all the time, in the event you maintain this rise.

This website has quickly become my go-to source for [topic]. The content is consistently top-notch, covering diverse angles with clarity and expertise. I’m constantly recommending it to colleagues and friends. Keep inspiring us!

Thanks For The Feedback

Yesterday, while I was at work, my cousin stole my iphone and

tested to see if it can survive a twenty five foot drop, just so she can be a youtube sensation. My iPad is now broken and she has 83 views.

I know this is totally off topic but I had to share it with someone!

Hello there, just became aware of your blog through Google, and found that it is really informative.

I’m going to watch out for brussels. I will be grateful if you continue

this in future. Numerous people will be benefited

from your writing. Cheers!

Thanks Alot, Really Appreciated!